Augment

Underwriters need to spend time looking up risk information from various sources and spend up to 30% of their time on data collection. Our Risk Analysis APIs augments your data with over 30 data sets for every address in the US, Canada, Europe, and the UK.

Prioritize

As opposed to “first in first out” approach, you can prioritize the submissions based on our AI based risk score and AI based “more likely to bind” score. This helps underwriters and portfolio managers to prioritize the underwriting work to maximize financial returns.

Select

More than half of submissions you receive are beyond your appetite. Our risk scoring algorithm identifies these submissions making sure that underwriters don’t waste time on unnecessary work. By filtering out these high-risk submissions automatically, you improve your loss ratio by up to 7-points.

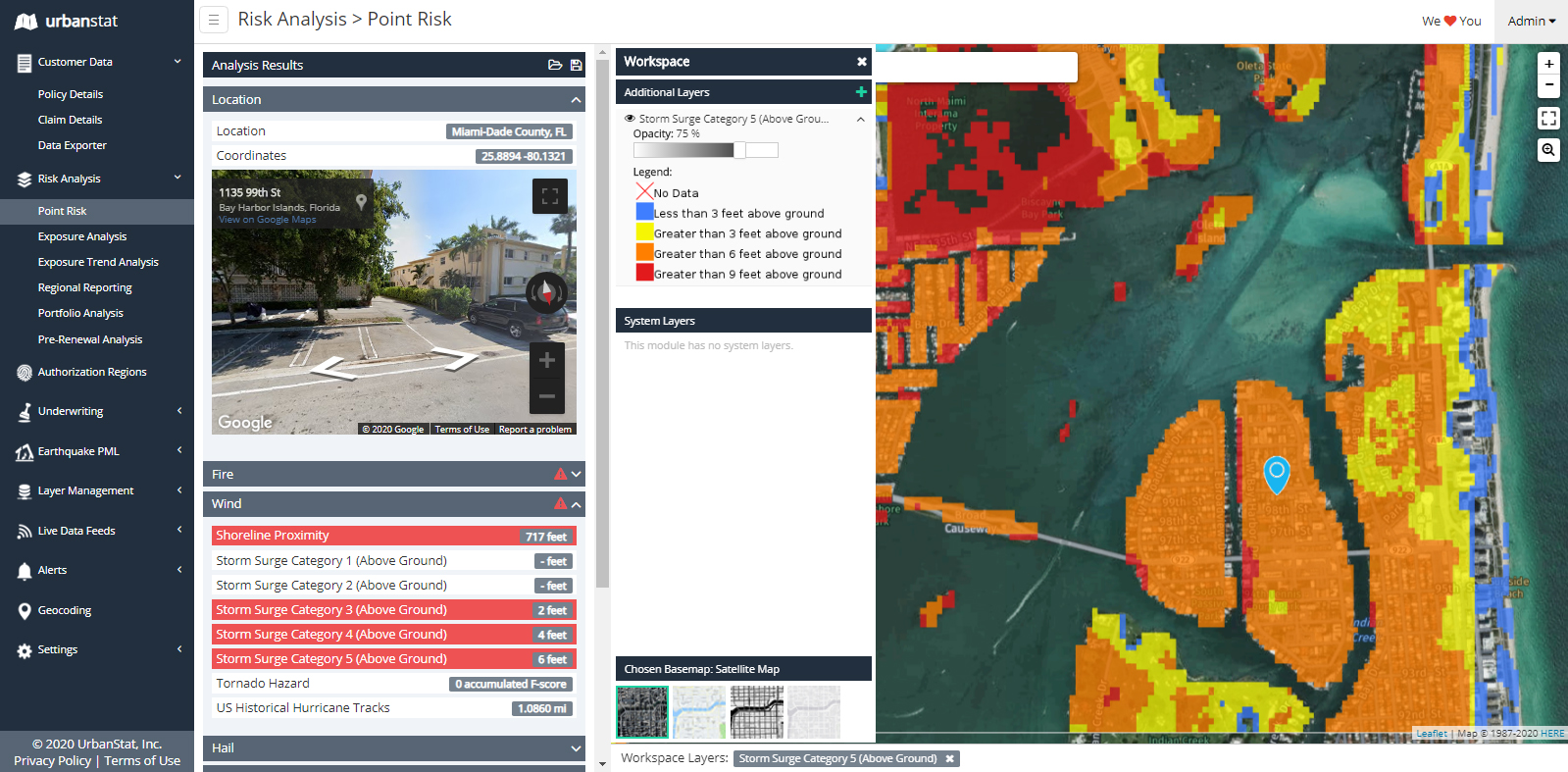

Point Risk

Type in an address, Policy No, or coordinates, UrbanStat Risk Analysis API will analyze the property location with over 30 different data points such as Tornado, Hail, Flood, Tropical Storms, Building Age etc. including our proprietary Wildfire Risk Map for California.

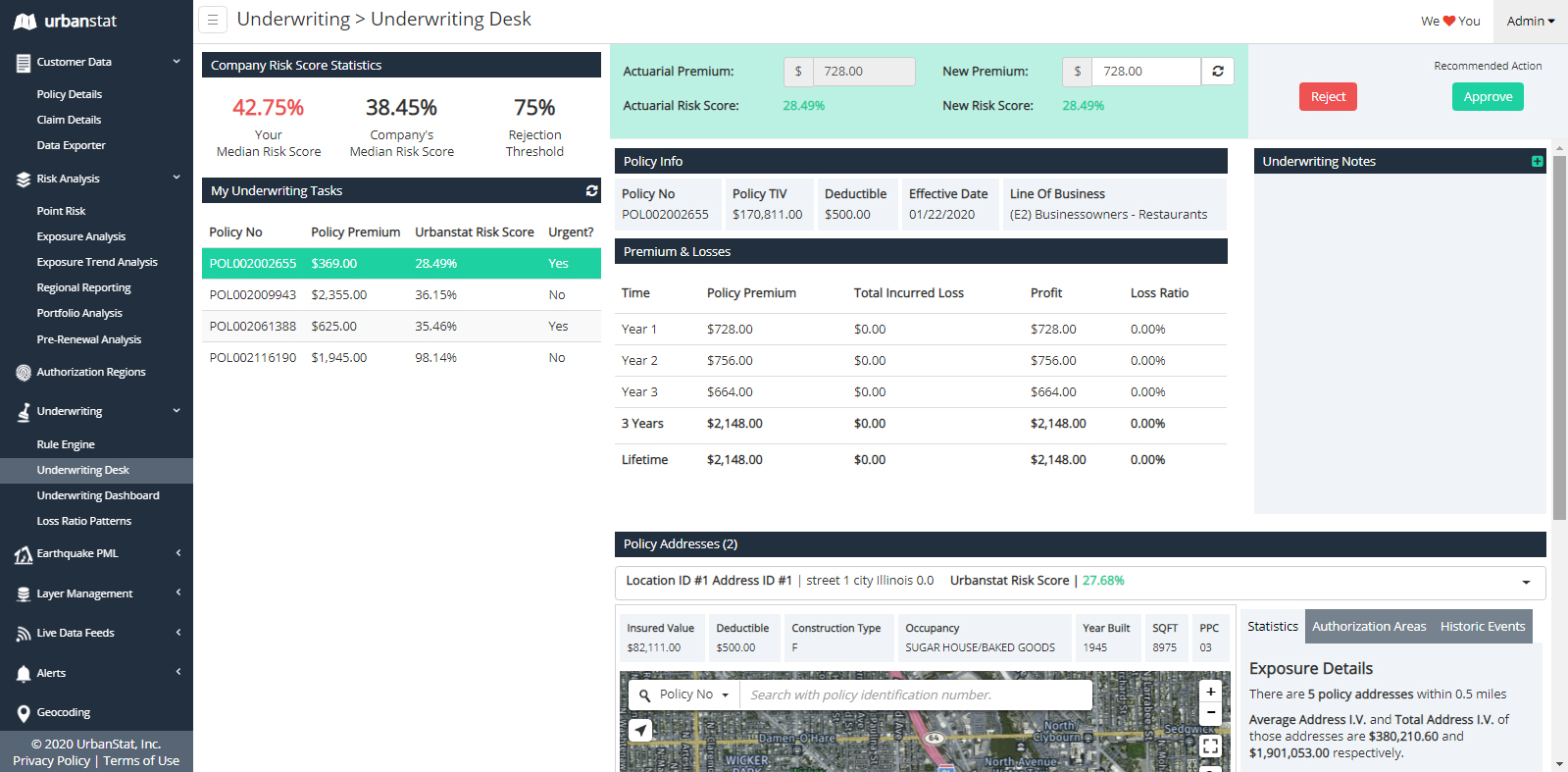

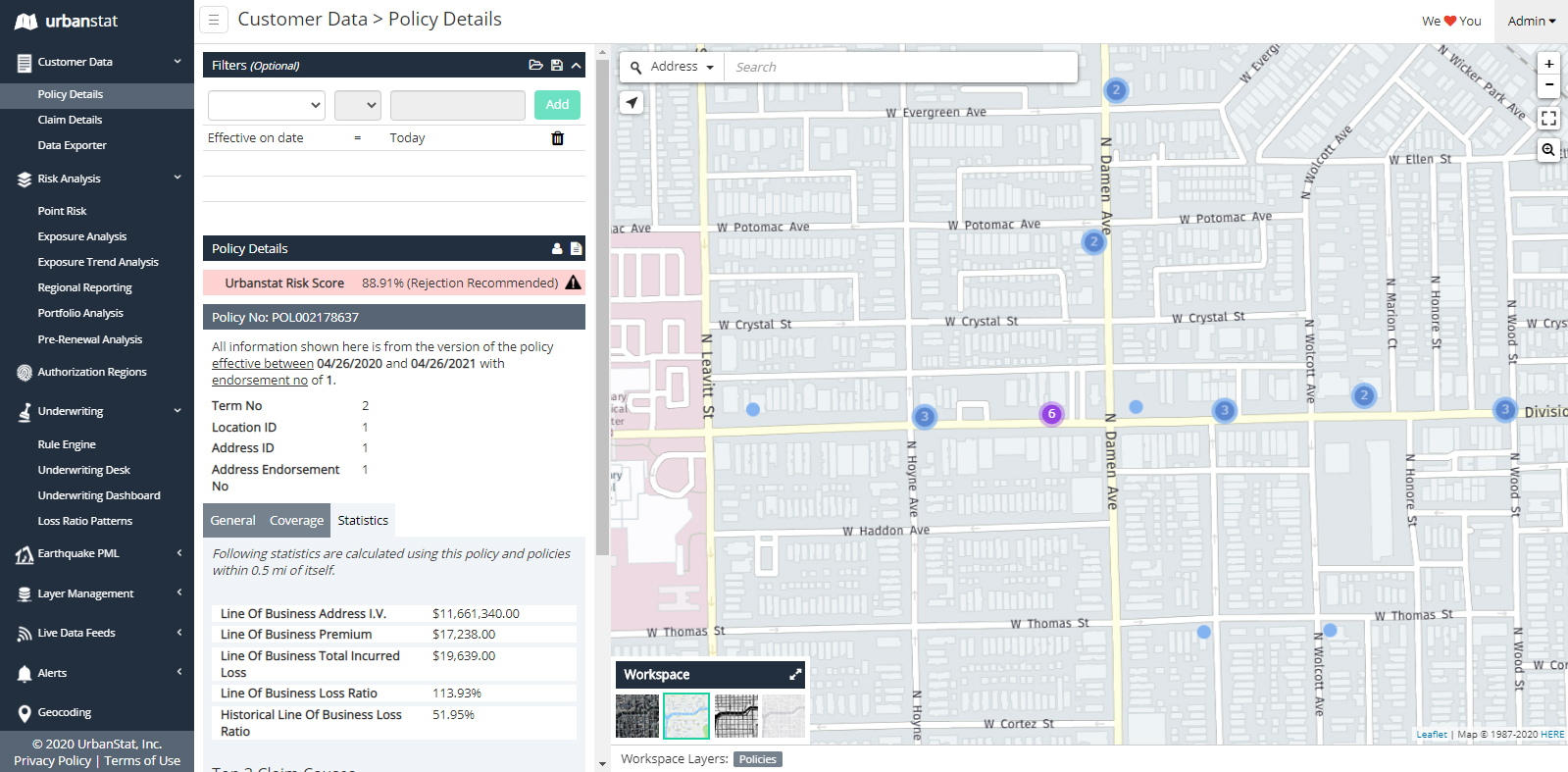

Underwriting Desk

Underwriting Desk enables you to access all relevant information about the property in just one dashboard. Our APIs will pull in customer information from your core systems and we will augment the information with other data and analytics including, our proprietary UrbanStat Risk Score, P&L calculations, location based risk analytics, aggregation calculations, historic event analysis, “most common claims in the area” analysis, and finally moratoriums and underwriting guidelines. All in one screen, easy to access and easy to view.

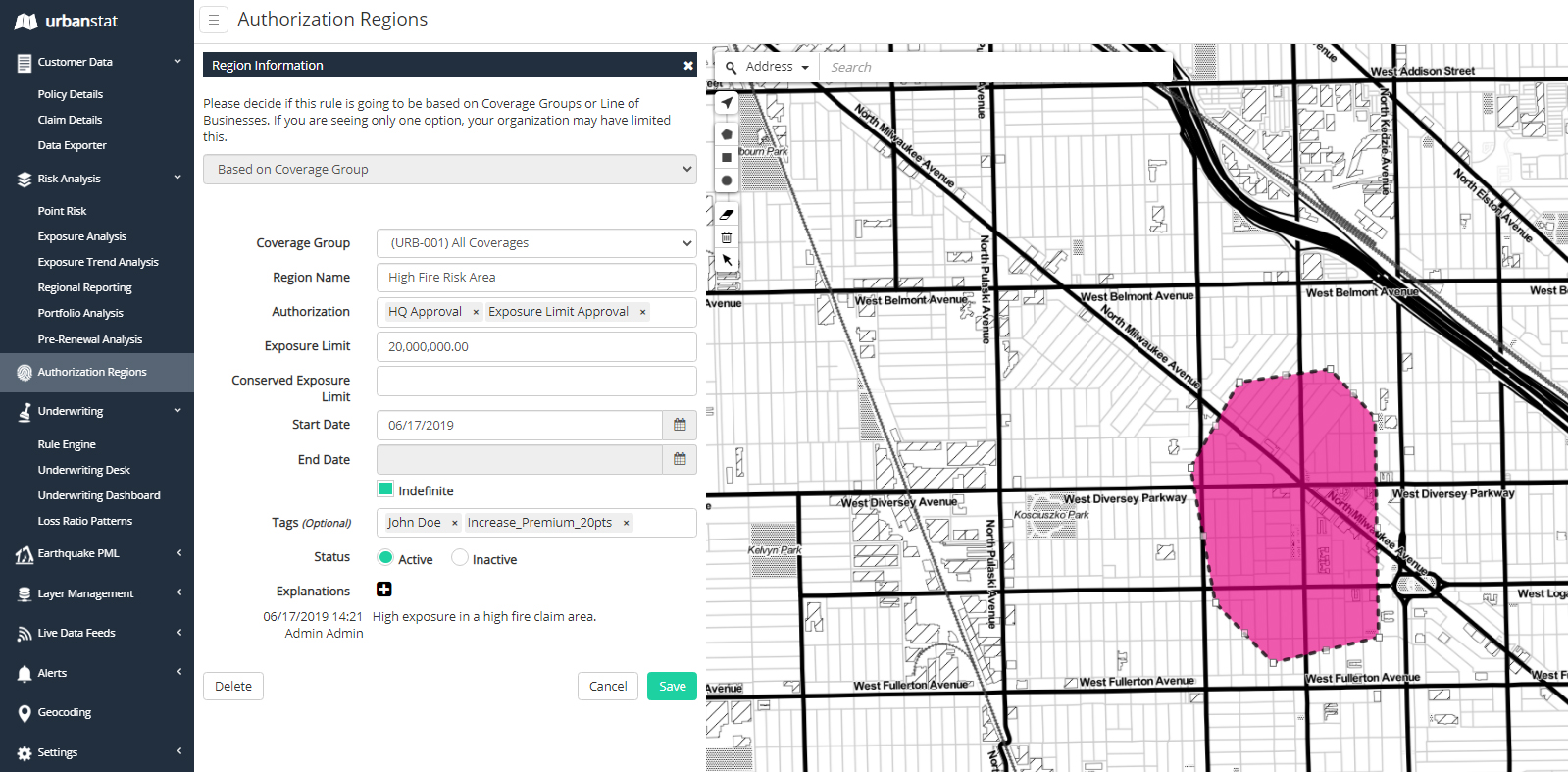

Underwriting Guidelines/Moratoriums

Insurance companies have hundreds of underwriting guidelines and moratoriums. Sometimes they are hard to set up, harder to review, and impossible to manage. With our “Authorization Regions” module, creating, reviewing and managing Underwriting Guidelines and Moratoriums have never been easier. You simply draw a polygon, set up your parameters and click “Save”. UrbanStat Risk Analysis API takes care rest of it. This way you don’t have to set up moratoriums for entire States or Counties.

Renewals

You accept a client to your portfolio and that client is a great fit for you at that moment. What about next year? The year after? Our Policy Details module allows you to review your policy along with rest of your portfolio in that specific area and helps you understand if this policy holder is still a good fit for your portfolio.

Use our APIs or User Interfaces

Risk Analysis API

1 API call, over 100 analysis results, less than 5 seconds. You can use our APIs to create your own experiences within your own core systems. The good news is we are already integrated with Duck Creek and OneShield, integrating to other core systems takes only a few weeks.

User Interfaces

Are you looking for a new underwriting system? You can use our user interfaces and start underwriting better today. Our user interfaces function in modern web browsers on PC, Tablets and Smart Phones.